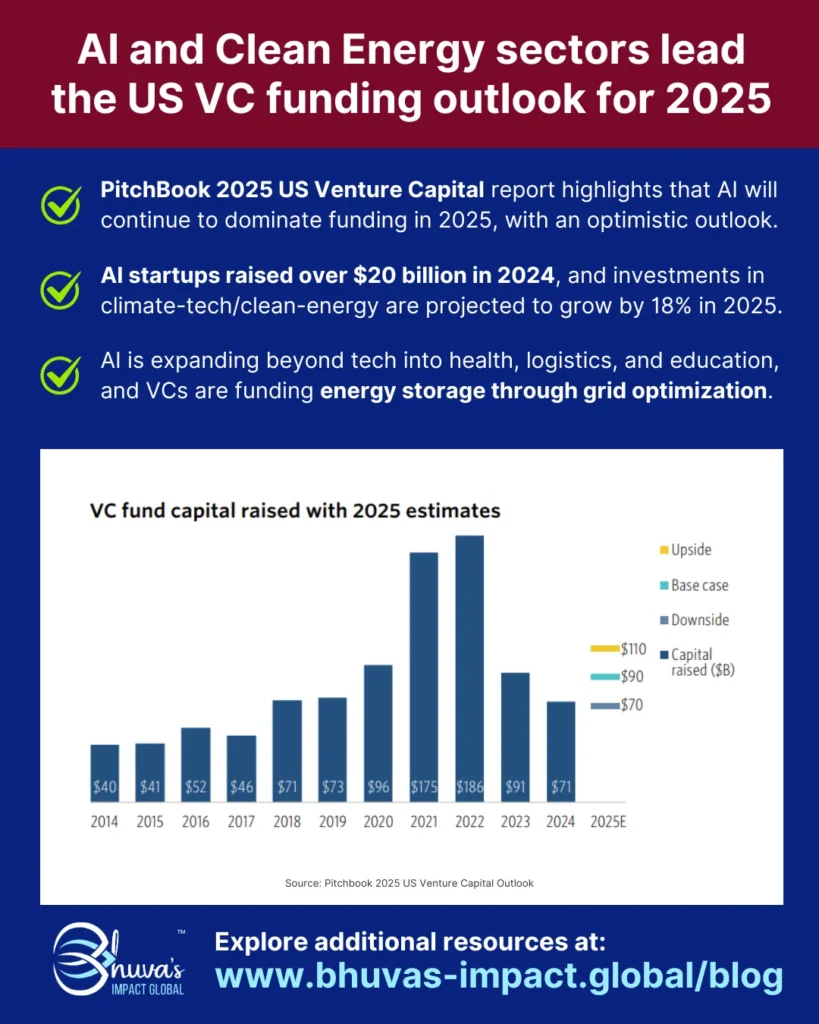

The 2025 US Venture Capital Outlook from PitchBook paints a fascinating picture of resilience and focus in a dynamic market. As I read through the report, it became clear that AI and clean energy are the sectors to watch, driving innovation and attracting significant capital.

Here’s what’s shaping the VC trends across these 2 transformative industries: AI and Clean Energy.

1️⃣ AI – Redefining Possibilities: AI continues to dominate venture capital attention, with applications expanding beyond tech into sectors like healthcare, logistics, and education.

Key trends include:

🔸Generative AI – transforming creative industries and product design.

🔸AI-powered automation – streamlining supply chains and reducing costs.

🔸Healthcare AI – accelerating diagnostics and personalized medicine.

The report highlights that AI startups raised over $20 billion in 2024, a testament to the sector’s vast potential.

2️⃣ Clean Energy – Powering the Future: The energy transition is fueling an unprecedented wave of innovation. Venture capitalists are backing startups tackling everything from energy storage to grid optimization.

Top areas of focus include:

🔸Advanced battery technology – to improve energy storage and scalability.

🔸Green hydrogen – as a clean energy alternative for heavy industries.

🔸Decentralized energy solutions – like microgrids for underserved communities.

With investments in climate tech and clean energy projected to grow by 18% in 2025, this sector is a cornerstone of sustainable development.

📌 Why it matters: These sectors are more than just investment opportunities—they’re reshaping industries and addressing global challenges head-on.