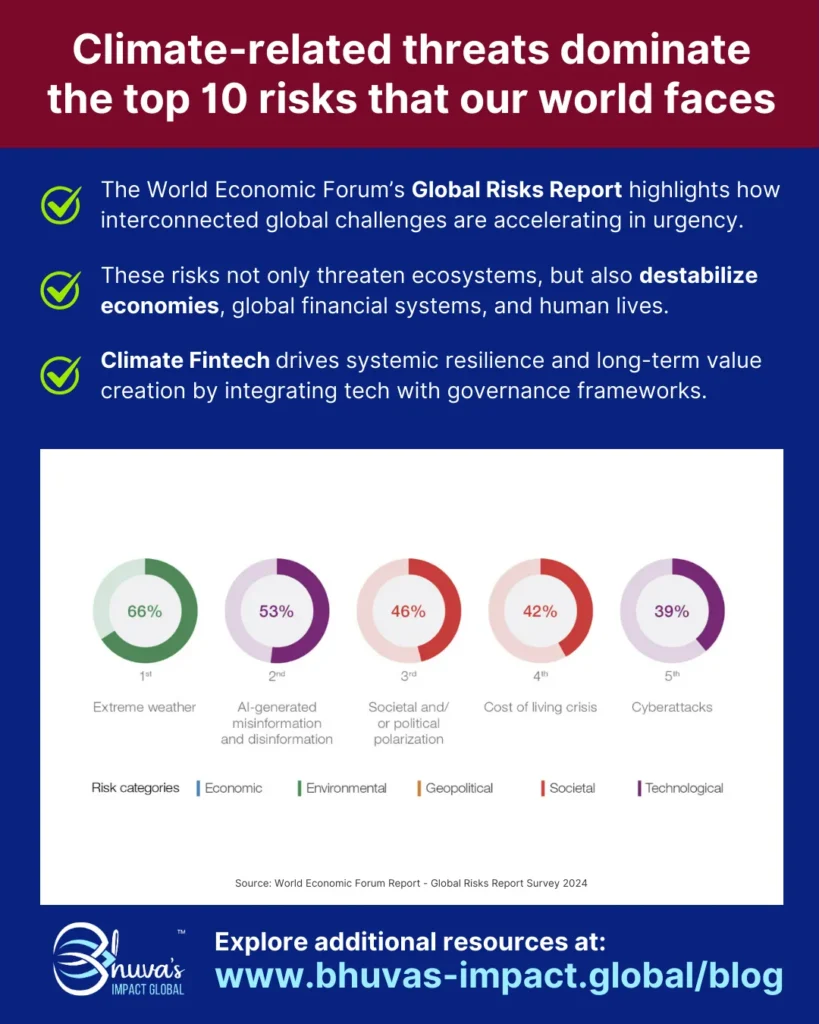

The World Economic Forum’s Global Risks Report highlights how interconnected global challenges—climate change, biodiversity loss, energy transitions, and supply chain vulnerabilities—are accelerating in urgency.

These risks not only threaten ecosystems but also destabilize economies and global financial systems.

🌱 Climate fintech isn’t just reacting to risks—it’s enabling solutions that turn challenges into opportunities.

By integrating technology with governance frameworks, we can drive systemic resilience and long-term value creation.

Here are 4 global risks that demand action and how climate fintech can address them:

1️⃣ Extreme Weather Events:

As the frequency of catastrophic weather events rises, AI-powered fintech platforms can offer predictive risk modeling, helping insurers, governments, and businesses mitigate financial and operational impacts.

2️⃣ Biodiversity Loss:

With half of global GDP moderately or highly dependent on nature, biodiversity-linked financial products—like tokenized natural assets—can channel investments into ecosystem restoration and sustainable land use.

3️⃣ Supply Chain Disruptions:

Global supply chains face increasing vulnerability from climate events. Blockchain technology provides transparency and traceability, enabling businesses to build climate-resilient supply networks and adapt to shifting risks.

4️⃣ Energy Transition Complexities:

The transition to renewable energy is vital but fraught with financial and operational challenges. Carbon credit marketplaces and AI-driven tools for energy efficiency can accelerate adoption while ensuring equitable access to clean energy.