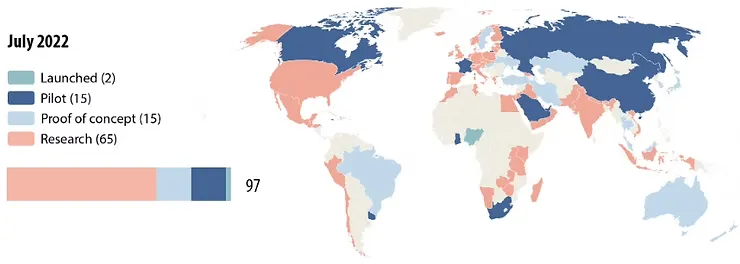

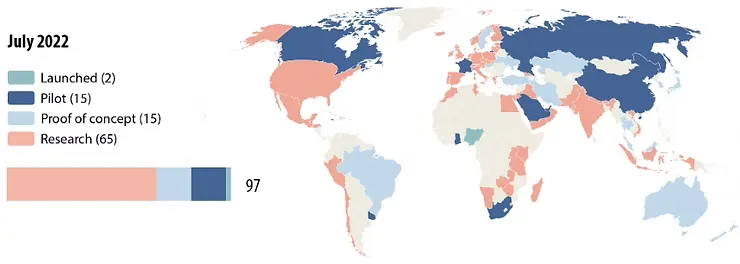

International Monetary Fund and CBDC Tracker are reporting a decline in the use of cash, and the pandemic digital transformation has accelerated the exploration of Central Bank Digital Currencies (CBDC) globally. Central Banks are evaluating relevant regulations to secure their value, minimize volatility, and improve the overall efficiency and safety of payment systems.

Countries have different motives for exploring and issuing CBDCs, including the need to serve the unbanked and the underbanked populations was a critical decision criterion. Startups like Wallet Max are committed to empowering everyone with secure and inclusive financial access and providing quality investment #education worldwide.

While CBDCs may increase transparency in money flows – many challenges are yet to be practically tested by financial institutions, like cyberattacks, data privacy and trust, end-to-end transaction integrity; and there are risks associated with the conversion of cash to digital currency in a large scale withdrawal by the general public from the global banks.