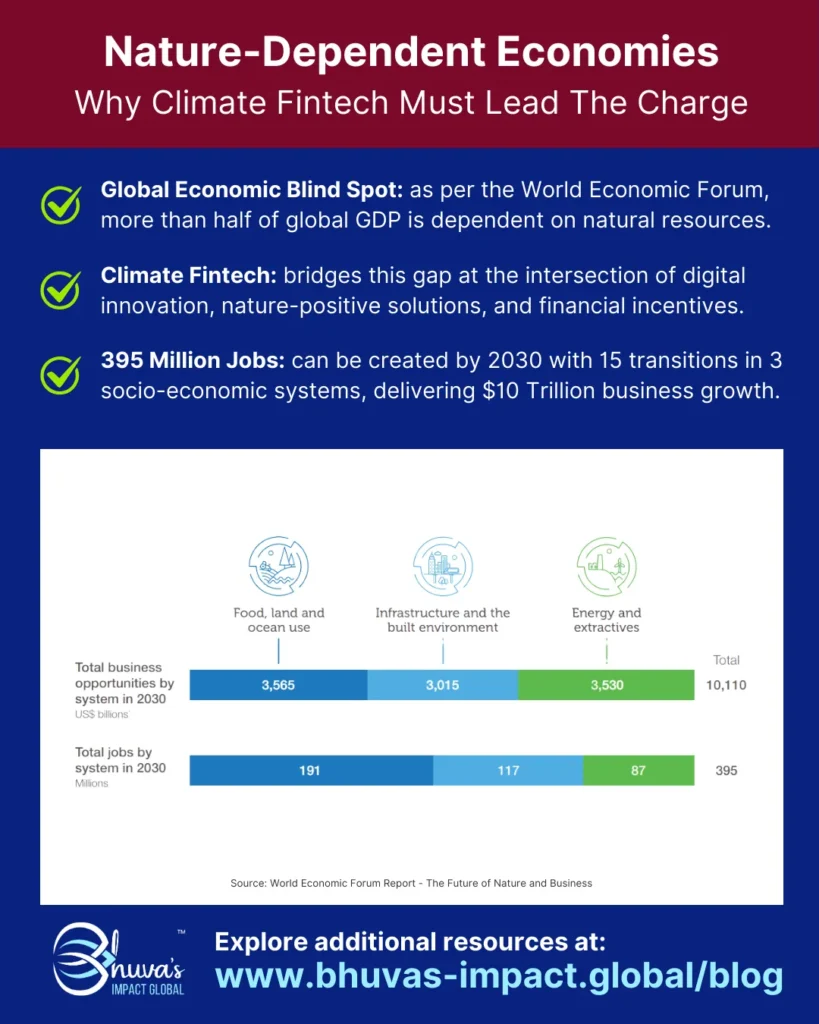

More than half of global GDP—around $44 trillion—is dependent on nature and its services. Yet, as highlighted in the CDP Europe Report – financial institutions have been slow to address the growing risks associated with nature loss.

The World Economic Forum’s New Nature Economy Report calls this oversight a “systemic risk” to both economies and businesses – a global economic blind spot.

The good news? Climate Fintech is uniquely positioned to bridge this gap by driving innovations that align nature-positive solutions with financial incentives:

➡️ Digital platforms for biodiversity-linked loans and green bonds,

➡️ AI-powered tools to quantify and mitigate ecosystem risks, and

➡️ Transparent frameworks for tracking and reporting on nature-related investments.

For example, the World Economic Forum estimates that transitioning to nature-positive pathways could unlock $10.1 trillion in annual business opportunities and create 395 million jobs by 2030.

📈 This isn’t just about protecting the planet—it’s about safeguarding the future of global economies. The question isn’t whether we can afford to invest in nature, but whether we can afford not to.